Understanding Bonding Curves: Complete Guide to Sui Memecoin Platform

Bonding curve platform Sui technology powers the most innovative memecoin launchpad on sui network. Our bondingcurve platform sui provides continuous liquidity and predictable pricing for sui memecoin creation and trading. Learn how our fairlaunch sui mechanism works and why it's the best pumpfun on sui alternative.

What Are Bonding Curves in Sui Memecoin Launchpad?

A bonding curve platform is a mathematical function that defines the relationship between sui memecoin supply and price. Unlike traditional order book exchanges, our bondingcurve platform sui provides continuous liquidity through algorithmic pricing - perfect for meme launchpad on sui operations and fairlaunch sui mechanisms.

The Basic Formula

The most common bonding curve follows this relationship:

Price = k × Supply^n

Where:

kis a constant that determines the initial priceSupplyis the current token supplynis the curve steepness (typically between 0.5 and 2)

Types of Bonding Curves

1. Linear Bonding Curve

Price = k × Supply

Characteristics:

- Constant price increase per token

- Predictable and simple

- Lower volatility

Use Cases: Stable utility tokens, governance tokens

2. Exponential Bonding Curve

Price = k × Supply^2

Characteristics:

- Exponential price growth

- Higher volatility

- Rewards early adopters significantly

Use Cases: Sui memecoin projects, speculative tokens on meme launchpad on sui

3. Square Root Bonding Curve

Price = k × √Supply

Characteristics:

- Diminishing price increases

- More stable at higher supplies

- Balances growth and stability

Use Cases: Community tokens, platform tokens

Advantages of Bonding Curves

1. Continuous Liquidity

Unlike traditional markets that can suffer from liquidity gaps, bonding curves provide liquidity at any price level. You can always buy or sell tokens, though the price will move according to the curve.

2. Predictable Pricing

The mathematical relationship between supply and price is transparent and predictable. Users can calculate exactly how their purchase will affect the token price.

3. No Liquidity Providers Needed

Traditional AMMs require liquidity providers to deposit token pairs. Bonding curves generate liquidity algorithmically, removing the need for external LPs.

4. Rug Pull Protection

Since liquidity is generated by the curve itself and tokens are minted/burned rather than traded, there's no liquidity pool that can be withdrawn by malicious actors.

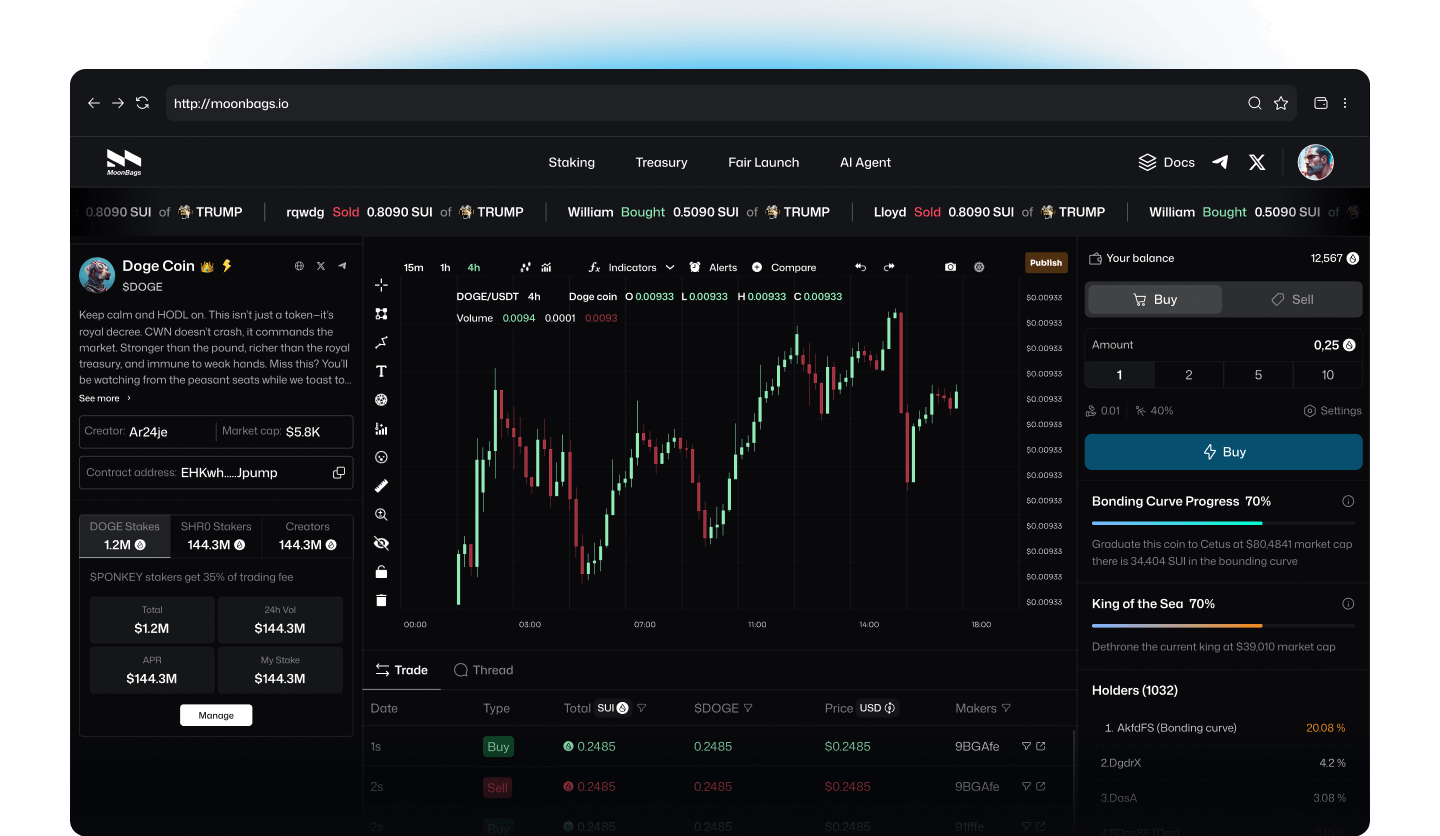

Moonbags Implementation

At Moonbags memecoin launchpad on sui network, we've implemented the most sophisticated bonding curve platform sui with several enhancements for sui memecoin creators:

Enhanced Curve Models

We support multiple curve types:

- Linear curves for stable growth

- Exponential curves for meme coins

- Custom curves tailored to specific tokenomics

Dynamic Parameters

Our bonding curves can adjust parameters based on:

- Trading volume

- Market conditions

- Community governance decisions

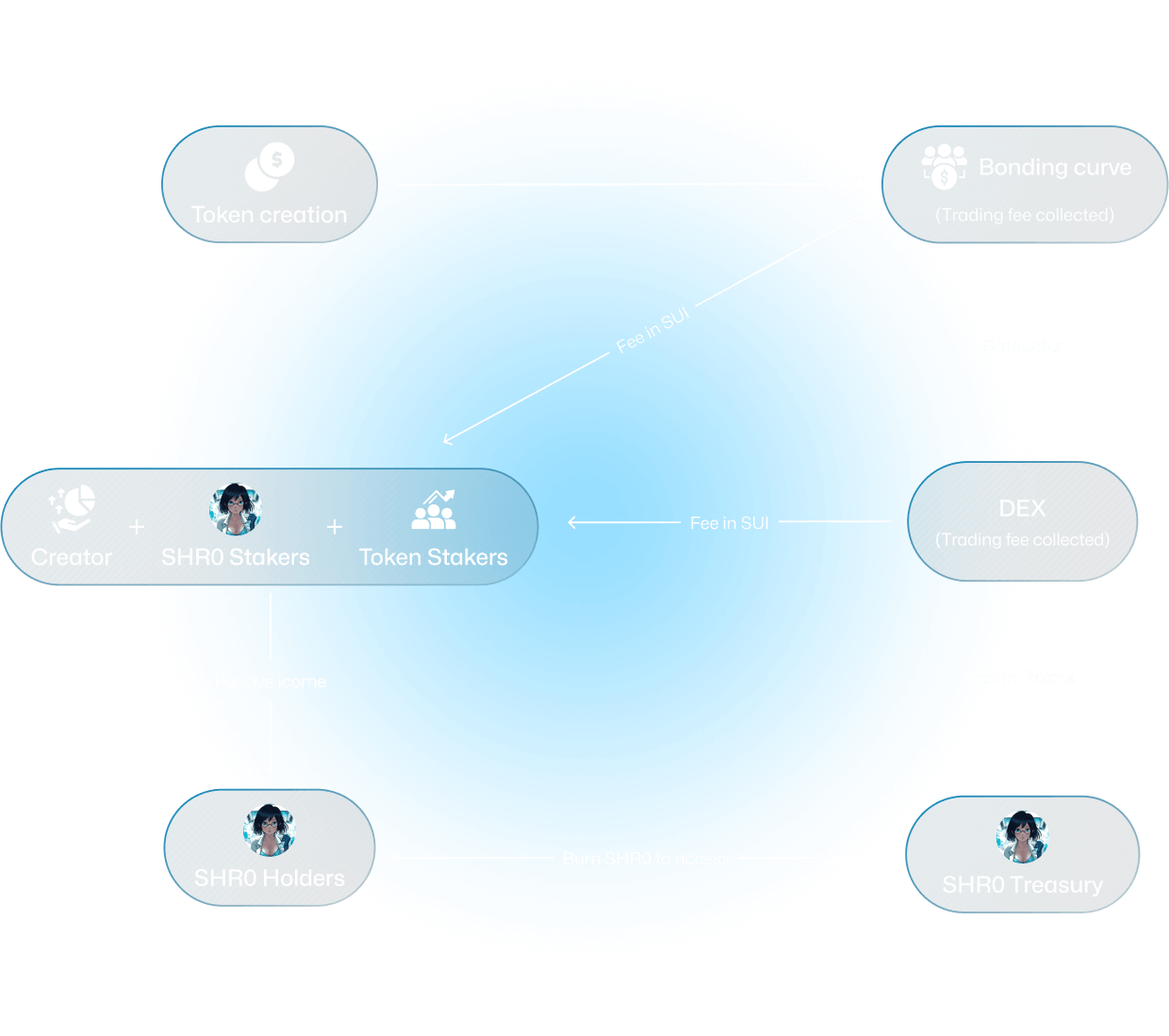

Fee Structure

Transparent fee structure:

- Buy fee: 2% of transaction value

- Sell fee: 4% of transaction value

- Revenue sharing: 50% goes to stakers

Mathematical Examples

Let's walk through some examples to understand how bonding curves work in practice.

Example 1: Linear Curve

Given: Price = 0.001 × Supply

- At 1,000 tokens: Price = 0.001 × 1,000 = $1.00

- At 2,000 tokens: Price = 0.001 × 2,000 = $2.00

- At 3,000 tokens: Price = 0.001 × 3,000 = $3.00

Each additional 1,000 tokens increases the price by $1.00.

Example 2: Exponential Curve

Given: Price = 0.000001 × Supply^2

- At 1,000 tokens: Price = 0.000001 × 1,000² = $1.00

- At 2,000 tokens: Price = 0.000001 × 2,000² = $4.00

- At 3,000 tokens: Price = 0.000001 × 3,000² = $9.00

The price increases exponentially, rewarding early buyers significantly.

Integration with Sui Blockchain

Our bonding curve implementation leverages Sui's unique features:

Object-Centric Model

Each token created through our bonding curves is a unique Sui object, enabling:

- Fine-grained ownership tracking

- Efficient state management

- Parallel transaction processing

Move Language Benefits

Sui's Move language provides:

- Mathematical precision for curve calculations

- Safety guarantees preventing arithmetic errors

- Gas efficiency for complex computations

Best Practices for Traders

Timing Your Trades

- Early Entry: Consider entering early in exponential curves for maximum gains

- Dollar-Cost Averaging: Spread purchases across time to average out price movements

- Exit Strategy: Plan your exit points based on the curve mathematics

Risk Management

- Understand the Curve: Study the mathematical relationship before trading

- Monitor Supply Changes: Track token minting/burning that affects price

- Set Limits: Use our automated tools to set buy/sell limits

Future Developments

We're continuously improving our bonding curve implementation:

Planned Features

- Multi-asset curves supporting token baskets

- Governance-adjustable parameters for community control

- Cross-chain curve synchronization for multi-chain tokens

- Advanced analytics for curve performance tracking

Research Areas

- Adaptive curves that learn from market behavior

- Hybrid models combining bonding curves with traditional AMMs

- Risk-adjusted curves that factor in volatility

Conclusion

Bonding curves represent a fundamental shift in how we think about token economics and market making. By understanding the mathematics behind these mechanisms, traders and project creators can make more informed decisions and build more sustainable token economies.

At Moonbags, we're committed to making these powerful tools accessible to everyone while maintaining the mathematical rigor that makes them effective. Whether you're a seasoned DeFi veteran or new to the space, our bonding curve platform provides the tools you need to participate in the next generation of token economics.

Want to experience bonding curves firsthand? Try our simulator at moonbags.io/simulator to see how different curve parameters affect token pricing.