DeFi Staking Guide: Maximize Your Crypto Rewards on Sui

Staking has become one of the most popular ways to earn passive income in DeFi. With the Sui blockchain's innovative architecture and Moonbags' advanced staking mechanisms, users can now access unprecedented opportunities to maximize their crypto rewards. This comprehensive guide will walk you through everything you need to know about DeFi staking on Sui.

What is DeFi Staking?

DeFi staking is the process of locking up your cryptocurrency assets to earn rewards while supporting network operations or protocol functionality. Unlike traditional staking that only secures network consensus, DeFi staking can serve multiple purposes:

Types of DeFi Staking

- Network Staking: Securing the blockchain consensus mechanism

- Liquidity Staking: Providing liquidity to trading pools

- Governance Staking: Participating in protocol governance

- Yield Farming: Earning rewards from multiple protocols simultaneously

Why Stake on Sui?

Unique Advantages

Lightning-Fast Execution

- Sub-second finality: Instant reward calculations and distributions

- Parallel processing: Multiple staking operations simultaneously

- Low gas fees: More of your rewards stay in your pocket

Advanced Smart Contracts

- Move language safety: Provably secure staking contracts

- Formal verification: Mathematical guarantees of reward distribution

- Object-centric model: Efficient state management for complex staking strategies

Ecosystem Growth

- Expanding DeFi protocols: More staking opportunities

- Institutional adoption: Increasing TVL and stability

- Developer incentives: Continuous protocol improvements

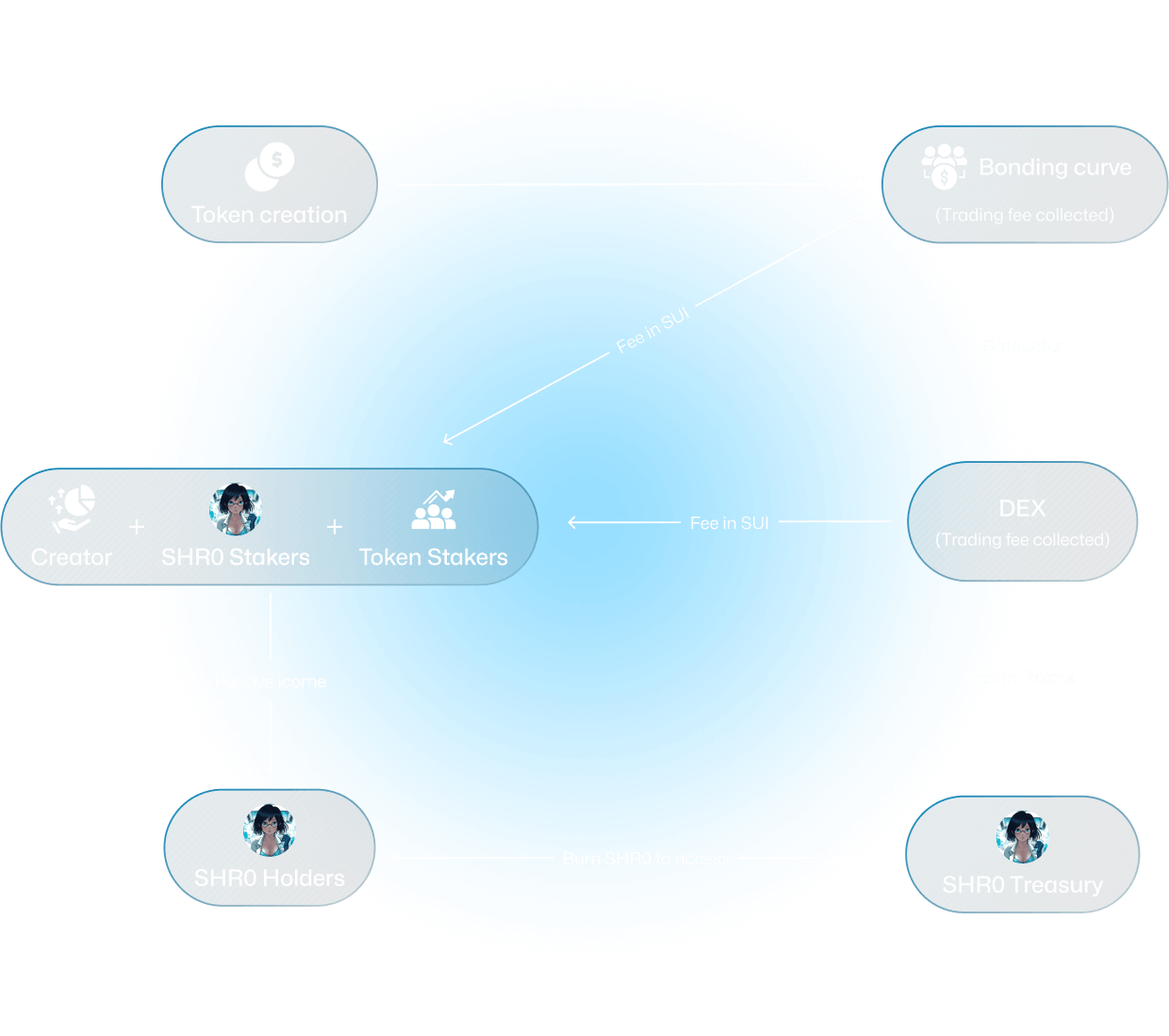

Moonbags Staking Ecosystem

Core Staking Features

1. Native SUI Staking

Annual Yield: 3-5%

Lock Period: 21 days minimum

Rewards: Compounding SUI tokens

Risk Level: Low

2. Meme Token Staking

Annual Yield: 15-50%

Lock Period: Flexible (1-365 days)

Rewards: SUI + Platform tokens

Risk Level: Medium to High

3. LP Token Staking

Annual Yield: 20-100%

Lock Period: No lock required

Rewards: Trading fees + incentives

Risk Level: Medium (impermanent loss)

4. Governance Staking

Annual Yield: 8-12%

Lock Period: Flexible

Rewards: Voting power + fee sharing

Risk Level: Low to Medium

Innovative Staking Mechanisms

Dynamic Reward Rates

Our staking rewards adjust based on:

- Pool utilization: Higher rewards for less popular pools

- Market conditions: Increased incentives during volatile periods

- Protocol performance: Revenue-sharing based on platform success

Auto-Compounding

- Automatic reinvestment: Rewards are automatically restaked

- Gas optimization: Batch transactions reduce costs

- Compound frequency: Daily compounding for maximum efficiency

Multi-Asset Staking

- Basket staking: Stake multiple tokens in one transaction

- Risk diversification: Spread exposure across different assets

- Rebalancing: Automatic portfolio optimization

Calculating Staking Rewards

Key Metrics to Understand

Annual Percentage Yield (APY)

APY = (1 + r/n)^n - 1

Where:

r = nominal annual interest rate

n = number of compounding periods per year

Real vs. Nominal Yields

- Nominal APY: Raw percentage return

- Real APY: Adjusted for inflation and fees

- Risk-adjusted APY: Factoring in potential losses

Example Calculations

Simple Staking (No Compounding)

Investment: 1,000 SUI

APY: 5%

Duration: 1 year

Rewards = 1,000 × 0.05 = 50 SUI

Total Value = 1,050 SUI

Compound Staking (Daily Compounding)

Investment: 1,000 SUI

APY: 5%

Compounding: Daily (365 times/year)

Duration: 1 year

Final Value = 1,000 × (1 + 0.05/365)^365 = 1,051.27 SUI

Additional compound benefit = 1.27 SUI

Multi-Token Staking

Staked Assets:

- 500 SUI at 5% APY

- 100 USDC at 8% APY

- 50 BTC at 3% APY

Annual Rewards:

- SUI: 500 × 0.05 = 25 SUI

- USDC: 100 × 0.08 = 8 USDC

- BTC: 50 × 0.03 = 1.5 BTC

Risk Management in DeFi Staking

Types of Risks

1. Smart Contract Risk

- Code vulnerabilities: Bugs in staking contracts

- Audit status: Always check if contracts are audited

- Time-tested protocols: Prefer established platforms

Mitigation Strategies:

- Diversify across multiple protocols

- Start with smaller amounts

- Check audit reports and team credentials

2. Impermanent Loss (LP Staking)

When providing liquidity, token price changes can cause losses compared to holding assets separately.

Example:

Initial Position:

- 1 ETH ($2,000) + 2,000 USDC = $4,000 total

After ETH doubles to $4,000:

- LP position: ~1.41 ETH + 1,414 USDC = $4,828

- Holding separately: 1 ETH + 2,000 USDC = $6,000

- Impermanent loss: $1,172

Mitigation:

- Choose stable pairs (stablecoin/stablecoin)

- Monitor price correlations

- Consider impermanent loss protection

3. Protocol Risk

- Governance attacks: Malicious proposals

- Economic exploits: Flash loan attacks

- Centralization: Single points of failure

4. Market Risk

- Token price volatility: Staked assets can lose value

- Interest rate changes: Affecting relative attractiveness

- Regulatory changes: Potential legal restrictions

Risk Assessment Framework

Low Risk (Conservative)

- Native blockchain staking (SUI)

- Established stablecoin pairs

- Audited, time-tested protocols

- Expected APY: 3-8%

Medium Risk (Balanced)

- Blue-chip token staking

- Diversified LP positions

- Governance participation

- Expected APY: 8-20%

High Risk (Aggressive)

- New protocol farming

- Volatile token pairs

- Leveraged strategies

- Expected APY: 20%+

Advanced Staking Strategies

1. Yield Farming Rotation

Move assets between protocols to maximize returns:

Week 1-2: High APY new protocol (50% APY)

Week 3-4: Stable established protocol (15% APY)

Week 5-8: Long-term staking for bonus multipliers

2. Liquidity Mining Optimization

Maximize rewards from multiple sources:

- Base APY: LP token rewards

- Bonus tokens: Protocol incentives

- Fee sharing: Trading fee distribution

- Governance tokens: Future value appreciation

3. Staking Derivatives

Use liquid staking tokens for additional strategies:

SUI → stSUI (liquid staking derivative)

↓

Use stSUI as collateral for borrowing

↓

Leverage position for higher yields

4. Cross-Protocol Strategies

Combine multiple protocols for synergistic effects:

- Stake SUI on native validator (5% APY)

- Mint derivative token representing staked position

- Use derivative in LP pool (additional 15% APY)

- Stake LP tokens for protocol tokens (10% APY)

- Total effective APY: 30%+

Moonbags Staking Features

User-Friendly Interface

One-Click Staking

- Simple asset selection

- Automatic optimal pool routing

- Gas estimation and optimization

- Transaction preview and confirmation

Portfolio Dashboard

- Real-time portfolio value

- Historical performance charts

- Reward tracking and projections

- Risk analysis and recommendations

Advanced Features

Smart Rebalancing

// Automated rebalancing logic

public fun rebalance_portfolio(

portfolio: &mut StakingPortfolio,

target_allocations: vector<u64>,

ctx: &mut TxContext

) {

// Assess current allocations

let current_weights = calculate_weights(portfolio);

// Determine rebalancing needs

let rebalance_actions = calculate_rebalancing(

current_weights,

target_allocations

);

// Execute rebalancing transactions

execute_rebalancing(portfolio, rebalance_actions, ctx);

}

Yield Optimization

- Automated compound frequency: Optimize between gas costs and compound benefits

- Cross-pool arbitrage: Move funds to highest-yielding opportunities

- Risk-adjusted targeting: Balance yield and safety based on user preferences

Security Features

Multi-Signature Controls

- Treasury management: Multi-sig for protocol funds

- Emergency controls: Circuit breakers for unusual conditions

- Upgrade governance: Community-controlled contract upgrades

Insurance Integration

- Smart contract coverage: Protection against code vulnerabilities

- Slashing insurance: Coverage for validator penalties

- Impermanent loss protection: Compensation for LP losses

Getting Started: Step-by-Step Guide

Step 1: Setup and Preparation

Wallet Configuration

- Install Sui Wallet or compatible wallet

- Fund with SUI for gas fees

- Import or purchase tokens to stake

Risk Assessment

- Determine risk tolerance (conservative/balanced/aggressive)

- Set allocation targets (% in each risk category)

- Define time horizon (short/medium/long term)

Step 2: Choose Staking Strategy

For Beginners (Conservative Approach)

- Start with native SUI staking (3-5% APY)

- Use established protocols with long track records

- Stake small amounts initially to learn

For Intermediate Users (Balanced Approach)

- Diversify across multiple protocols

- Include some LP positions for higher yields

- Participate in governance for additional rewards

For Advanced Users (Aggressive Approach)

- Explore new protocols for maximum yields

- Use leverage and derivative strategies

- Active management with frequent rebalancing

Step 3: Execute Your Strategy

On Moonbags Platform

- Connect wallet to moonbags.io

- Navigate to Staking section

- Select assets and staking pools

- Review terms and APY rates

- Confirm transaction and start earning

Monitoring and Management

- Track performance regularly

- Rebalance when needed

- Claim rewards or enable auto-compounding

- Adjust strategy based on market conditions

Tax Considerations

Staking Reward Taxation

General Principles

- Income event: Rewards typically taxed as income when received

- Fair market value: Based on token price at receipt time

- Capital gains: Additional tax when selling staked tokens

Record Keeping

- Transaction history: All staking and unstaking events

- Reward tracking: Amount and value of all rewards

- Cost basis: Purchase price of original tokens

Tax Optimization Strategies

- Long-term holding: Reduce capital gains tax rates

- Tax-loss harvesting: Offset gains with losses

- Jurisdiction shopping: Consider tax-friendly locations

Common Mistakes to Avoid

1. Chasing High APY Without Understanding Risks

Problem: Focusing only on headline yields Solution: Always assess risk-adjusted returns

2. Not Diversifying Across Protocols

Problem: Single point of failure Solution: Spread assets across multiple platforms

3. Ignoring Lock-up Periods

Problem: Funds unavailable when needed Solution: Plan liquidity needs in advance

4. Failing to Monitor Performance

Problem: Missing opportunities or increasing risks Solution: Regular portfolio reviews and rebalancing

5. Not Understanding Impermanent Loss

Problem: Unexpected losses in LP positions Solution: Educate yourself on IL mechanics and mitigation

Future of DeFi Staking on Sui

Emerging Trends

Liquid Staking Evolution

- Cross-chain liquid staking: Stake assets from multiple chains

- Institutional grade solutions: Enterprise-focused products

- Automated strategies: AI-driven yield optimization

Regulatory Developments

- Clearer guidelines: More certainty for participants

- Institutional adoption: Regulatory compliance features

- Global standards: Cross-jurisdictional frameworks

Technology Improvements

- ZK-based privacy: Private staking positions

- Intent-based UX: Simplified user interactions

- Cross-rollup composability: Seamless multi-chain strategies

Moonbags Roadmap

Q1 2025

- Insurance integration: Smart contract and IL protection

- Mobile app: Native mobile staking interface

- Advanced analytics: Comprehensive performance tracking

Q2 2025

- Cross-chain staking: Multi-blockchain asset support

- Institutional features: Large-scale staking solutions

- DAO governance: Community-controlled protocol development

Q3 2025

- AI optimization: Machine learning yield strategies

- Privacy features: Confidential staking positions

- Social staking: Community-driven staking pools

Conclusion

DeFi staking on Sui represents a paradigm shift in how we think about earning yields on crypto assets. With Moonbags' innovative platform, users can access sophisticated staking strategies while benefiting from Sui's performance advantages and Move's security guarantees.

The key to successful DeFi staking lies in understanding the risks, diversifying your approach, and continuously educating yourself about new opportunities and best practices. Start conservatively, gradually increase your risk tolerance as you gain experience, and always prioritize security and due diligence.

As the Sui ecosystem continues to grow and mature, we can expect even more innovative staking mechanisms and opportunities. By staying informed and using platforms like Moonbags, you can position yourself to take advantage of these developments while building a sustainable, profitable staking portfolio.

Remember: DeFi staking is not just about earning yields – it's about participating in the future of finance while supporting the growth and security of groundbreaking blockchain networks.

Ready to start your DeFi staking journey? Visit moonbags.io/staking and begin earning rewards on your crypto assets today.